About 'ideal ratio of debt equity ratio'|Thoughts on CMED’s Debt and Equity

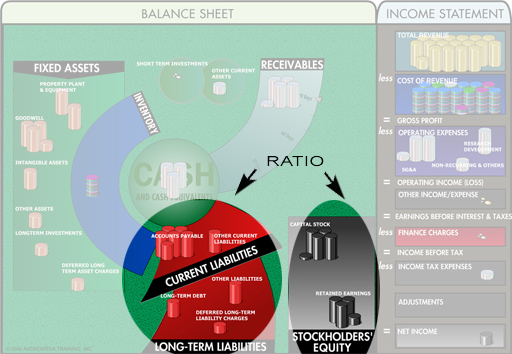

Canada has one of the world's lowest commercial lending interest rate at moment, as well as the mortgage rate, with United States not too far behind. Should you use debt to finance your business expansion in this environment? When you get serious about raising capital for your business (and anytime you need cash, it's serious), consider two major avenues: Debt financing means borrowing money for a fee. Debt financing is ideal, for example, when you don't want to dilute ownership of your business in exchange for the cash you need. Of course, on the downside, you have to repay the full amount of the debt plus interest at some point in the future. If the debt exceeds your ability to pay it back on schedule, you may be forced to liquidate assets or go into bankruptcy. Equity financing means selling a piece of your business in exchange for a cash investment. Equity financing is great if you don't want an obligation to repay a lender, but, on the downside, you have to give up a portion of your ownership in the business. Give up too much ownership, and you may lose control of your business. So which approach is better for your company? The answer to that question varies depending on the goals that you have for your business, the ability of your firm to repay its debt, the amount of money needed, and many other factors. Each approach has its good points and its bad. Many companies utilize a combination of both kinds of financing, maintaining a balance between the two. A business with a line of credit, automobile leases, and an assortment of trade credit and short-term loans (all forms of debt financing) may, for example, look to venture capitalists for an infusion of cash to fuel expansion, offer stock options to its employees, or float an initial public offering (IPO) of its stock (equity financing options). A company that doesn't use debt financing at one time or another is rare. You can find plenty of different ways to use debt to fuel your business. Here are some of the more common types of debt financing, just to give you a taste of what's available: Short-term commercial loans Long-term commercial loans Home equity loans Working capital lines of credit Leasing Credit cards Accounts receivable financing Inventory financing Corporate bonds Letters of credit Be careful about the extent to which you use debt financing in your business. Too much debt piled up against your available assets creates an unfavorable debt-to-equity ratio (which reflects upon your ability to repay your debt and can provide a clear warning sign to potential lenders '" generally a debt-to-equity ratio in excess of 1 is considered bad). |

Image of ideal ratio of debt equity ratio

ideal ratio of debt equity ratio Image 1

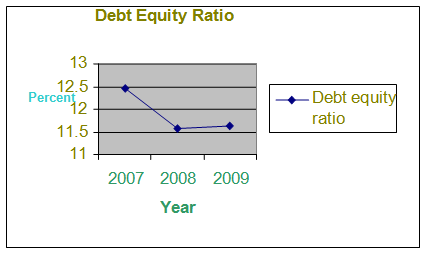

ideal ratio of debt equity ratio Image 2

ideal ratio of debt equity ratio Image 3

ideal ratio of debt equity ratio Image 4

ideal ratio of debt equity ratio Image 5

Related blog with ideal ratio of debt equity ratio

- tennesseeindependent.blogspot.com/...portfolio size from just $136M in 2006 to over $3.7B, financed with a continuous stream of equity and debt offerings; yet net asset value per share has been trending...

- mygoalkeeper.blogspot.com/...Salary (Earned Income). The goal of calculating for Wealth Ratio is to have your Passive and...near or far you are from your ideal retirement. Computing it NOW...

- valueblockbusters.blogspot.com/... forward, the debt/equity ratio is likely to remain...or bubble bursting of the Chinese economy. I prefer..., an ideal acquisition target would be one...

- basunivesh.wordpress.com/...30000/1100000=11.8%)11.8%. Ideal ratio should be around 20% to 30...all your sources of income stopped.It...available to use. In this Debt and Equity investments not...

- imperialtwilight.wordpress.com/...never been better. The major indices of corporate ‘health’ are: “debt-to-equity ratios, cash to credit ratios, profit margins, ...

- zacksman.wordpress.com/...All of these things combined make for a less than ideal picture for a stock, which of course makes it perfect for a potential short sale screen. Results...

- consortiumfinancenetwork.blogspot.com/... the classical advantages of leverage, but never wanted to risk being unable to determine what that optimal debt-equity ratio should be for Apple. Or he just didn't want...

- clearcommentary.typepad.com/my_weblog/...more, not to mention Obama's Chicago cohort, convicted felon Tony Rezko, the image of the ideal presidential candidate fails to materialize. Add to that mix the fact that Obama's...

- atubs.wordpress.com/...even with the Debt/Equity Ratio at 4 …70 debt/30 equity is the ...New Mining Law of Indonesia as a Risk factor... DCF an ideal Valuation basis As major...

- deepwealth.blogspot.com/...have a lower P/S ratio, because some of those sales...to cash, have to go toward debt interest and paying down debt -- not to equity holders. When...

Related Video with ideal ratio of debt equity ratio

ideal ratio of debt equity ratio Video 1

ideal ratio of debt equity ratio Video 2

ideal ratio of debt equity ratio Video 3

0 개의 댓글:

댓글 쓰기